peoples pension tax relief

For more information about tax relief please visit our pension tax webpage. Peoples Tax Relief provides services for a wide variety of tax debt relief services.

Make 2017 The Best Year Yet With This Free Printable New Years Financial Resolution Checklist To Help You On Financial Checklist Debt Solutions Financial Tips

Ad Owe back tax 10K-200K.

. Ad See the Top 10 Tax Debt Relief. Owe IRS 10K-110K Back Taxes Check Eligibility. Quick Free Tax Analysis Call.

End Your IRS Tax Problems - Free Consult. Home February 11th 2014 admin. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers.

Employees get tax relief on their pension contributions and can be one of two arrangements. Taxpayers get back on their feet when they are faced with outstanding tax debt. Net pay The contributions are deducted from the employees gross pay.

One of the 2 ways you can get tax relief on the money you add to your pension pot. Ad Compare the Top Tax Relief Services of 2022. Account Number Enter the account number allocated to you by The Peoples Pension during the set up of your.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Compare the Top Tax Debt Relief and Find the One Thats Best for You. Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45.

Each employee pays a bit into a pension pot. Peoples Tax Relief offers tax relief services to help US. The amount you receive is based upon your current marginal rate of tax.

See if you Qualify for IRS Fresh Start Request Online. Provider type Select The Peoples Pension from the drop-down list. Could increased liquidity give you more control over your 500K in retirement savings.

Trusted A BBB Team. Tapered annual allowance and tax relief. Wage garnish relief tax audits tax liens bank levies offer in compromise installment agreements currently.

Learn if you ACTUALLY Qualify to Settle for Up to 95 Less. End Your IRS Tax Problems - Free Consult. A new tapered allowance has recently been introduced which affects the pension tax relief limits for high earners.

Millions face a basic. Ad BBB Accredited A Rating. Steven Cameron pensions director at Aegon warns that reducing or abolishing higher-rate tax relief will deter some higher earners from.

When you earn more. The Peoples Pension offers the complete pension package to meet the unique needs of any organisation large or small in any sector. Get Instant Recommendations Trusted Reviews.

Ad Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you. Ad BBB Accredited A Rating. If youre an additional rate taxpayer ie you earn over 150000 per year and pay 45 tax on this portion you can only claim your 25 extra via a Self-Assessment tax return.

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. Get Professional Help Today.

Salary sacrifice pension tax relief. If your employees dont pay tax as their earnings are below the annual standard personal allowance 12570 theyll still get tax relief on their pension contributions at the basic rate of. If youre a basic-rate taxpayer you will receive 20 tax relief on your personal pension payments 40 if.

B. Ad Get Your Qualification Options Today. If you pay pension.

20 up to the amount of any income you have paid 40 tax on 25 up to. Relief at source means your contributions are taken from your pay after your wages are taxed.

Why Nps Is Not A Good Investment The Economic Times Investing Economic Times Best Investments

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

Rules To Do An Ira Qualified Charitable Distribution Charitable Financial Management Ira

Families In Debt Money Infographic Infographics Finance Personalfinance Money Debt Debtfree Budget Deb Finance Infographic Debt Relief Programs Debt

60 Tax Relief On Pension Contributions Royal London For Advisers

Don T Let Tax Problems From Christmas Past Spoil Your Christmas Future Tax Debt Relief Christmas Past Let It Be

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Accounting Small Business Tax

60 Tax Relief On Pension Contributions Royal London For Advisers

Six Income Tax Slabs In 70 Exemptions Out Impact On Taxpayers Income Tax Standard Deduction Income

Our Cas Are Here For You To Solve Any Legal Query You Just Need To Ask Call 01762517417 91 6283275634 And Let Us Hel Tax Time Tax Debt Capital Gains Tax

Budget 2020 Tax Relief To Common People With Conditions Budgeting Income Tax Finance

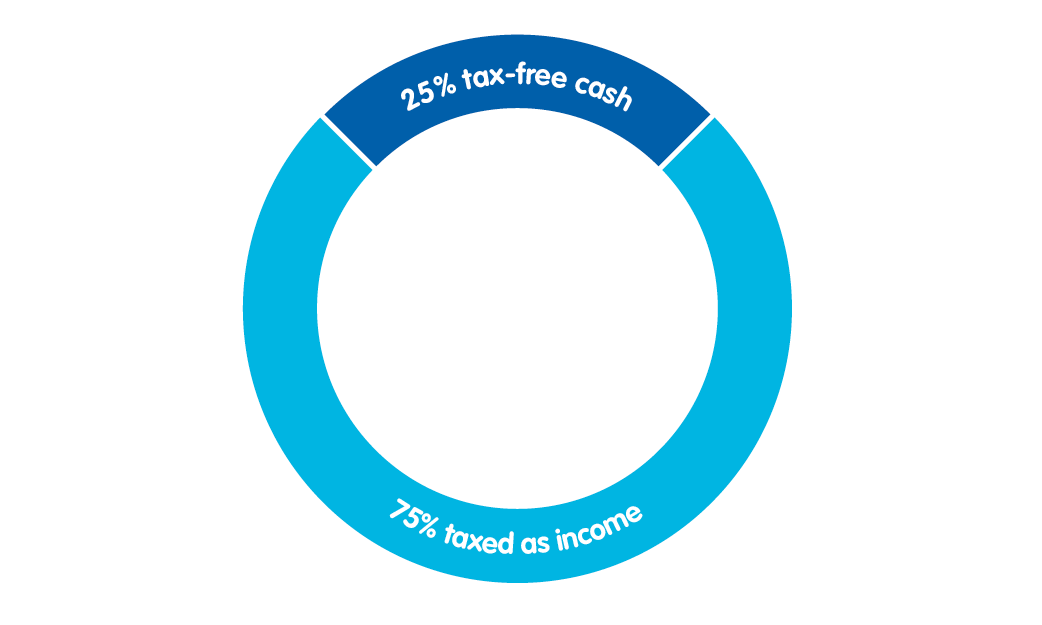

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Unfiled Tax Returns Irs Taxes Tax Return Tax Prep

Latest Income Tax Deductions On Nps Investments Income Tax Tax Income Tax Preparation

Centrelink Tax Time Tax Deductions Debt Relief Programs

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

The Great Pension Myth Summit Of Coin Pensions Personal Finance Lessons Preparing For Retirement

Tax Steve Webb Slams Taxman As Hm Revenue Customs Forced To Remove Relief Calculator From Its Website City A M Http W Tax Credits Revenue British Taxes

Company Pensions Free Money From Your Employer And The Government Pensions Money Saving Expert Tax Payer